partners & shared financial life

origin, 2022

Atomic Research ▫ Secondary Data ▫ Data Analysis ▫ Survey Design and Anlysis

Intro

Every quarter at Origin, the Research Team runs an open call for research bets and a betting table to decide long-term facing projects that will help us shape the future of our product strategy. This was one of those projects on what we call our Strategic Track. This was a project led by me, in collaboration with Beatriz Donha as a fellow UX Researcher. Stakeholders included our VP of Product, Product Managers, and Product Designers from different teams as well as Data Scientist and Engineering Managers.

Our challenge

Before our more recent shifts in team strategy and responsibilities, we were still actively participating in many different team-focused projects from our Validation and Tactical Tracks, by planning, moderating, and analyzing daily usability tests and feature discovery projects. For our Strategic Track, we set a constraint that projects should take no longer than a quarter to deliver valuable results, because, in an early stage fast-paced startup environment where roadmaps are defined for short time horizons, we don't have the luxury of knowing what our product strategy will look like further than 3 months ahead.

The main constraint of this project was to scope it in a way we could deliver meaningful insights for the next quarter while also working on a myriad of other faster-paced projects and constantly context-switching.

Revisiting our knowledge database looked a bit like this at first!

Research Process

Planning

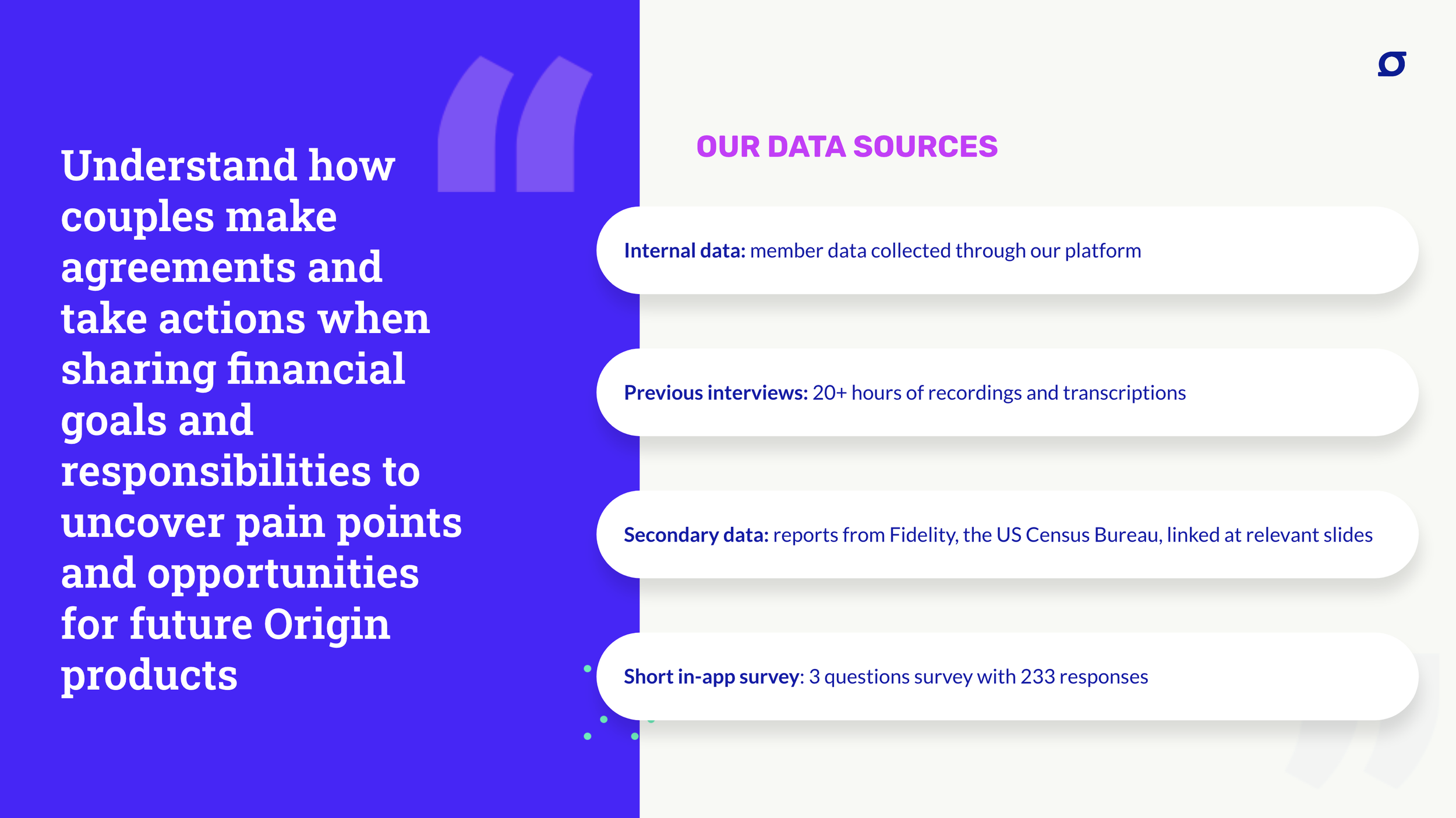

We had previously concluded from our own internal data that about half of our members (how we call the users from our customer-facing platform) managed their finances with a partner. This data point was self-reported through our own platform onboarding. We would then learn more about what other institutions had figured out about partners and their finances. Finally, with 1. the data we had internally, and 2. conclusions that the market had found, we would have a pretty good plan on 3. what we had yet to find out about our members, and design a survey that could touch on those gaps to build and size segments from different partners' agreements.

That being said, we knew from the beginning that it was very unlikely we would have time to conduct new qualitative research. We even included it as a tentative Phase 2 in our planning, but the realistic goal was to make use of previous interviews with members. Thanks to our efforts in tagging and storing transcriptions, we knew we had a lot of material from which to draw new conclusions.

Study Plan & Summary

-

big numbers from self-reported answers (our platform onboarding) and customers’ financial data pulled from internal data;

market reports and published white papers clipping and organization;

-

filtering related tags in our database to inform a partner segment creation;

new highlight reels from previous interviews;

-

contextual (in-app) survey design and analysis to validate and size our segments;

-

a combination of segment sizing, highlight video clips and opportunities for next quarter's roadmap.

Results and Takeaways

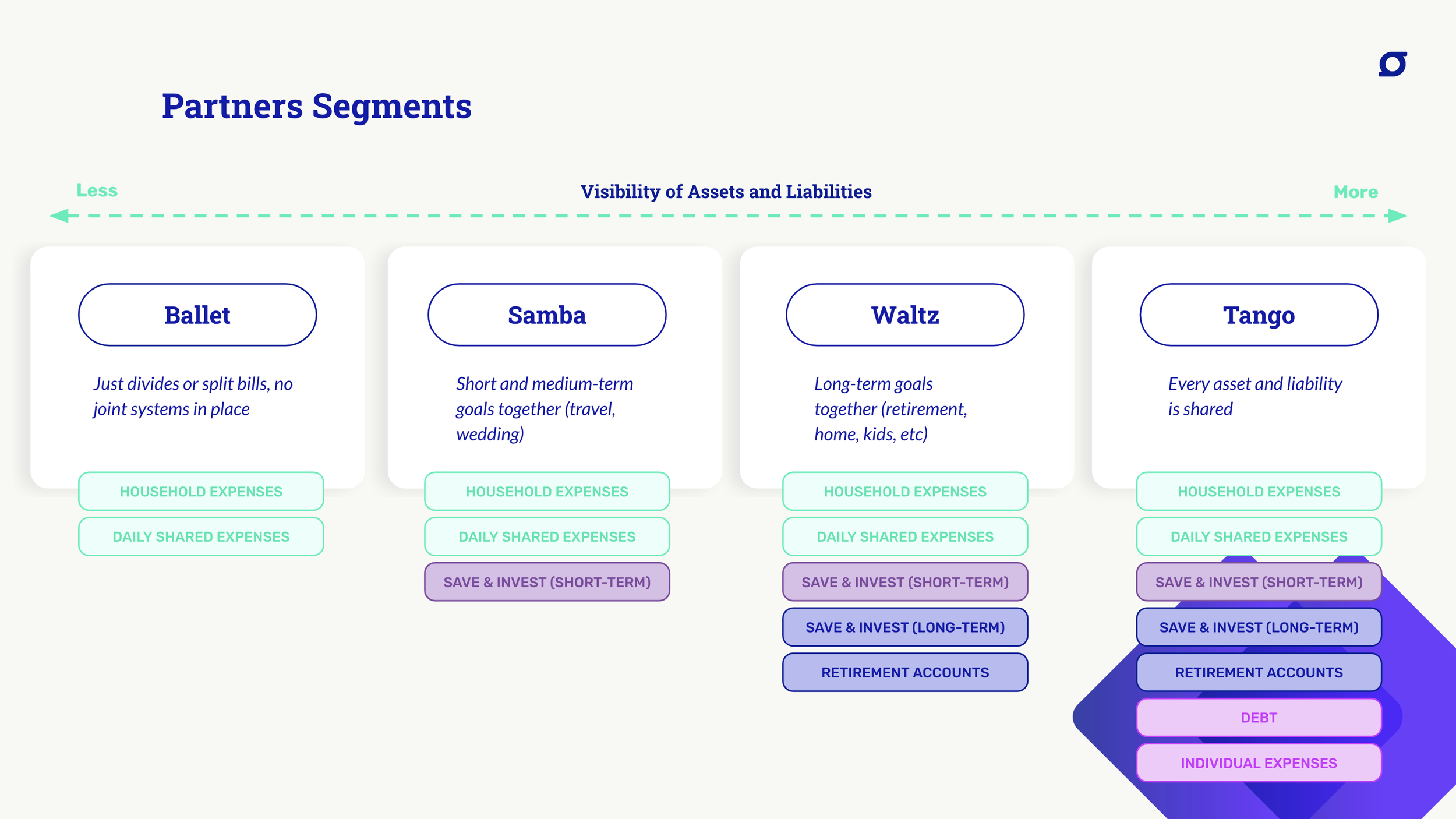

Segment-defining key variable

Taking a moment to look into secondary data was invaluable to building hypotheses that our previously collected qualitative data would strengthen before the survey design. Some of the market reports pointed us in the direction of partners having different levels of visibility in their individual expenses and debt. We expanded on that based on what we found in our knowledge database's tagged transcriptions and it became the backbone of this segmentation: “which assets or liabilities are partners willing to give full visibility on?”. As with any survey-based segmentation study, we can only tell it works once the survey results are out and our survey sample is distributed among the group. As a very small percentage of respondents fell into a N/A category (meaning their responses didn't fit our segmentation model), we were more than happy with how this model performed.

One of the segments was much more prevalent in our consumer base than the others, allowing us to focus our product strategy in a specific set of opportunities described in the final report.

Sample slides from the final report

Slides with sizing numbers and roadmap opportunities were purposefully omitted to preserve the confidentiality of this study.